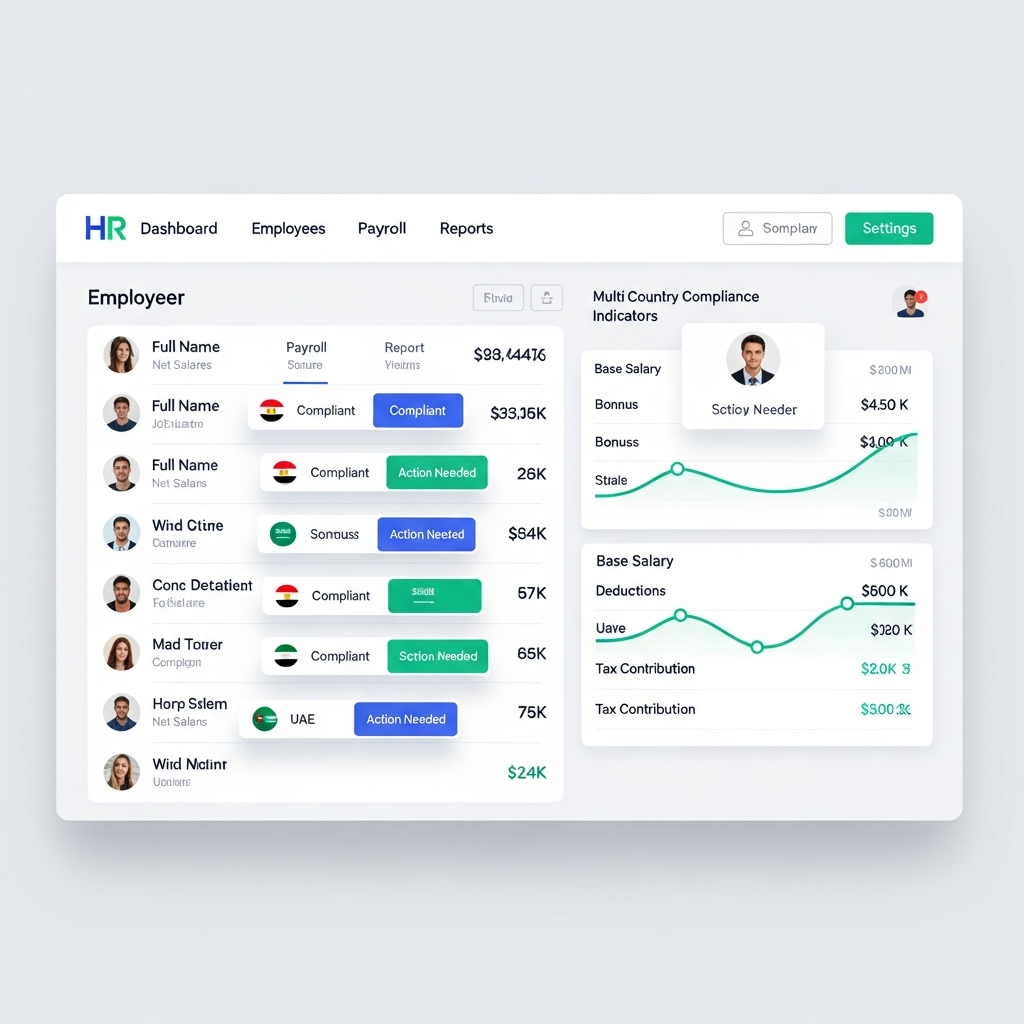

Core Features

Global payroll system with automated processing for 6 countries: Egypt, Saudi Arabia, UAE, USA, UK, and Germany

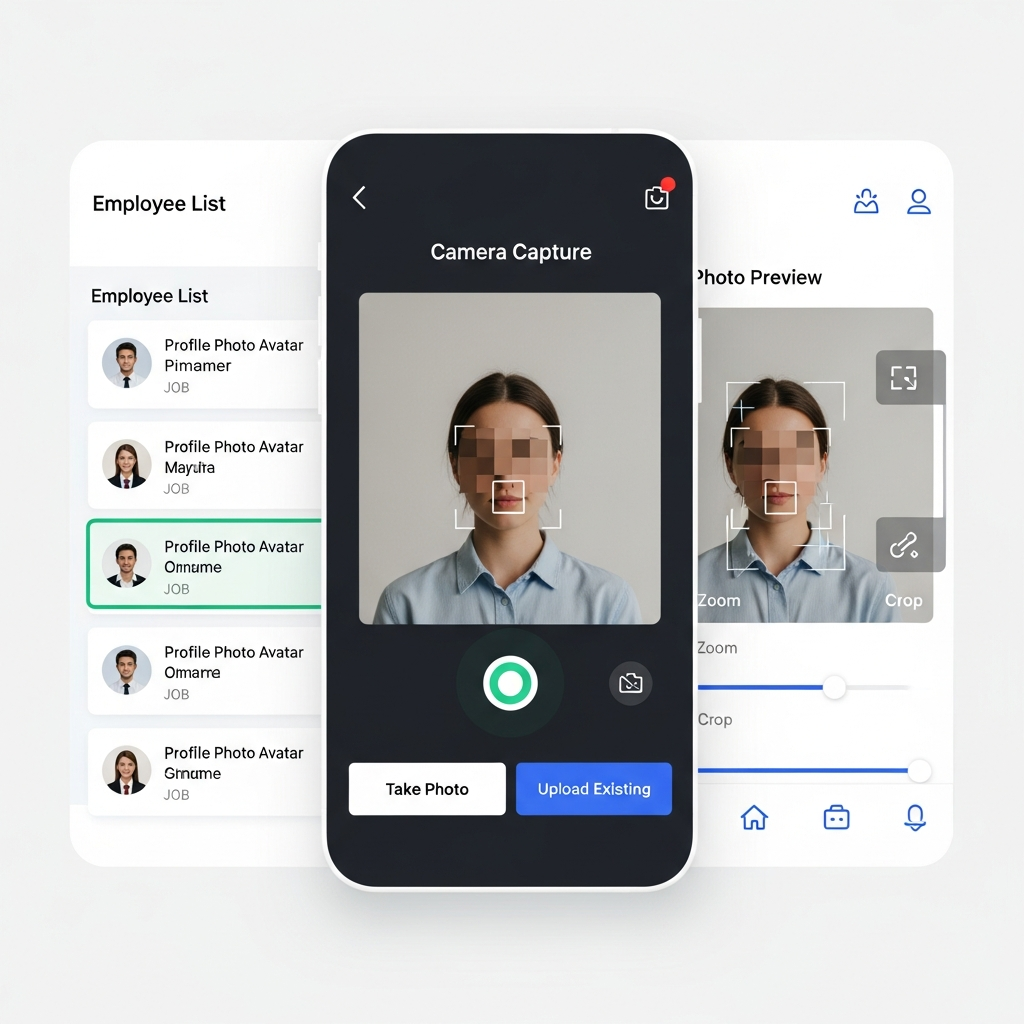

Employee Registry & Profiles

- Bilingual name support (English/Arabic)

- Employee profile photo management with camera capture

- Department and job position management

- Employee contracts with salary components

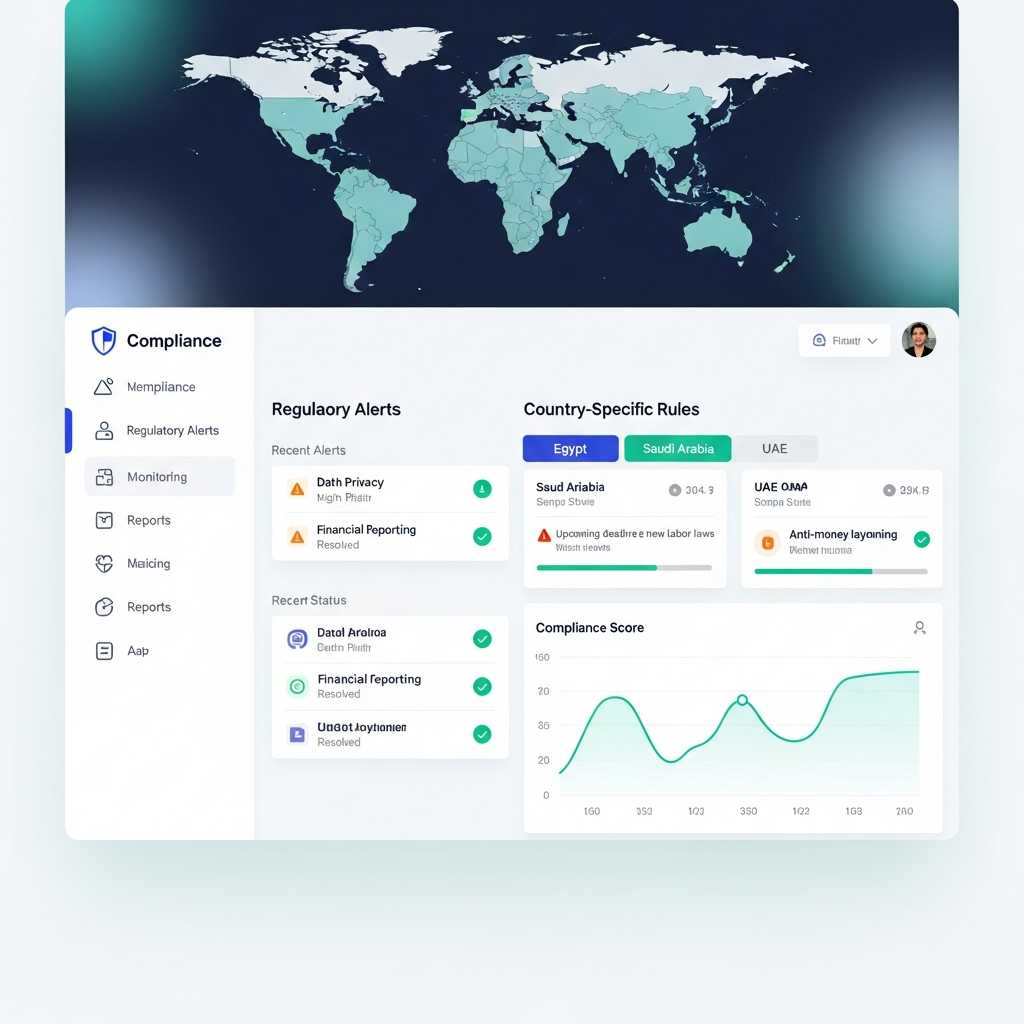

Statutory Compliance

- Egypt Social Fund calculations

- Saudi GOSI (General Organization for Social Insurance)

- UAE pension fund calculations

- End of Service Benefits (EOSB) per country law

Automated Payroll Processing

- Payroll period management

- Detailed breakdown with automatic calculations

- Employee and employer contributions

- One-click journal entry creation

- Complete audit trail with posting timestamps

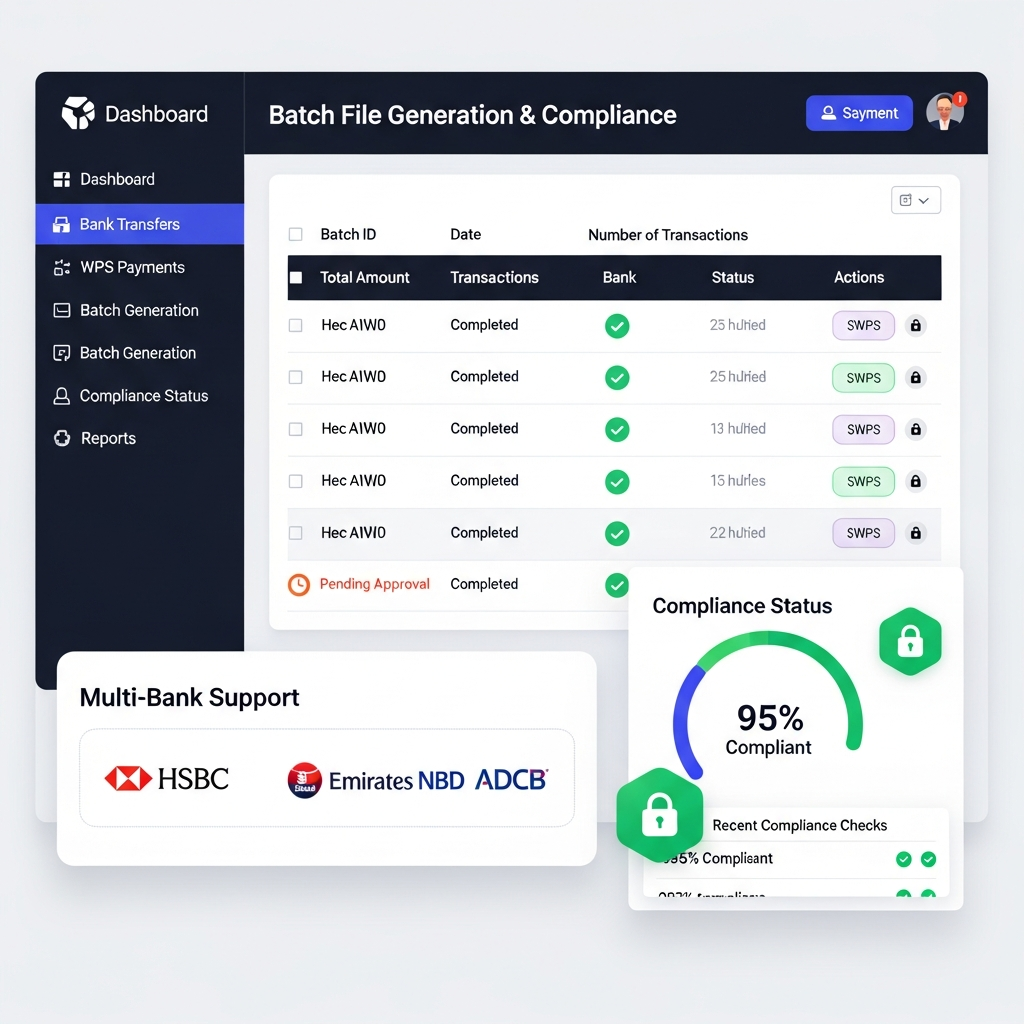

Bank Transfers & WPS Compliance

- WPS (Wage Protection System) compliant file generation

- Multi-bank support for diverse banking partners

- Batch file download for bank submission

- Secure encryption for payment data

- Real-time transfer status tracking